Brazil

Source: Trading Economics

Brazil’s IHS Markit Manufacturing PMI rose to 53.2 in February 2018 from 51.2 in January 2018. This was the seventh consecutive month of improvement in factory activity in Brazil and the strongest in three months. The data shows that New Orders and Output rose at a robust pace and was supported by domestic client demand which helped to offset a moderate fall in exports. Employment grew the most since March 2011 which was a reflection of higher business confidence. Input inflation eased to a four month low and remained overall amid higher prices of raw materials, such as steel. Due to this, manufacturers continued to pass some of their higher input costs to customers with selling prices rising at the fastest pace since June 2016. Brazil’s Manufacturing PMI is reported by Markit Economics.

Russia

Source: Trading Economics

Russia’s IHS Markit Manufacturing PMI dropped to 50.2 in February 2018 from 52.1 in January 2018. The latest reading pointed to the weakest pace of expansion in manufacturing activity since the contraction in July 2016. New orders rose the least in eight months, output advanced at the softest pace since October and buying activity grew marginally. Employment contracted at the fastest rate in nearly a year with backlogs also falling modestly. New export orders expanded the most since November 2011 and business sentiment reached a five-month high. Price pressures remained subdued with charges rising marginally driven by fragile demand conditions. Manufacturing PMI in Russia is reported by Markit Economics.

India

Source:Trading Economics

Source:Trading Economics

India’s Nikkei Manufacturing PMI unexpectedly fell to 51.2 in February 2018 from 52.4 in January 2018 missing the market consensus of 52.8. The reading indicated the weakest exapansion in manufacturing sector since October 2017. Output and new export orders increase at softer paces while new orders rose the least in four months. The data also indicates that buying activity went up at the slowest pace since a decline in October 2017. Employment grew slightly more than in a month earlier and business sentiment remained optimistic. On the price front, cost inflation accelerated to the fastest since February 2017. Manufacturers raised their output charges in an attempt to pass through higher cost burdens to clients. Manufacturing PMI in India is reported by Markit Economics.

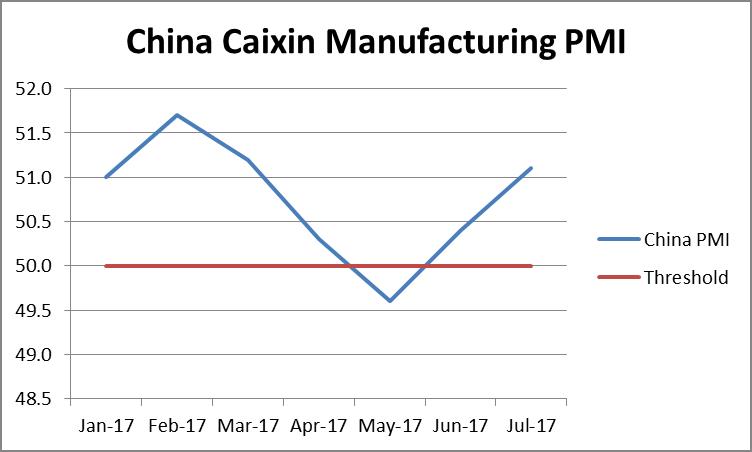

China

Source: Trading Economics

China’s Caixin Manufacturing PMI slightly increased to 51.6 in February 2018 from 51.5 in January 2018 coming in higher than the market consensus of 51.3. This was the highest reading since August 2017 as new orders grew slightly faster. The sentiment hit its highest in 11 months and output continued to rise. Buying activity increased modestly while firms continued to shed staff. Input price inflation eased to the lowest in seven months, but remained much stronger than that of output charges. Manufacturing PMI in China is reported by Markit Economics.

South Africa

Source: Trading Economics

ABSA’s Manufacturing PMI for South Africa rose 50.8 in February 2018 from 49.9 in January 2018. The latest reading pointed to the first expansion in factory activity since May last year. Firms expect an improvement in manufacturing amid a brighter outlook for the local economy. Manufacturing PMI in South Africa averaged 51.29 from 1999 until 2018. It reached an all time high of 64.20 in July of 2006 and a record low of 34.20 in April 2009.

A Manufacturing PMI reading above 50 is an indicator of an expanding manufacturing sector while a Manufacturing PMI below 50 is an indicator of a contracting manufacturing sector.

Brandon Msimanga

Economic and Investment Analyst

BCom Economics, University of Pretoria

BCom (Hons) Business Management, University of Pretoria